The NewCo model is becoming increasingly popular among Chinese biotech companies looking to expand internationally.

In this model, a Chinese biotech company gives overseas rights for its new drug to a newly created NewCo. The NewCo gets money from U.S. dollar investment firms. These firms provide funding, build an overseas team, and handle the drug’s development during clinical trials.

When the drug reaches a stage that meets the acquisition criteria of a multinational corporation (MNC), the NewCo exits through either an MNC acquisition or an independent public listing.

In return, the Chinese biotech company receives upfront payments, milestone fees, and sales royalties. Additionally, it retains a minority equity stake in the NewCo.

Why Biotech Companies Choose the NewCo Model

Chinese firms develop strong innovative drugs, but the global market, particularly the U.S., offers the greatest value. Over the past few years, investment in Chinese biotech has surged, creating many globally competitive products. However, domestic IPO challenges and limited drug reimbursement policies push companies to seek global commercialization.

Long-Term Value Sharing

Traditional licensing models generate quicker revenue through upfront payments from the licensee. In contrast, the NewCo model allows Chinese firms to retain ownership of global assets while leveraging international resources. Shareholders benefit from future commercialization, MNC acquisitions, or IPOs, maximizing long-term returns.

Flexible Capital Structure

Unlike traditional joint ventures, which require cash or physical asset contributions, the NewCo model allows intellectual property (IP) contributions under international investment structures. In China, contributing IP as capital is subject to regulatory uncertainties, including valuation and legal compliance. By structuring NewCo abroad, companies overcome these restrictions and attract international investment.

Investors put $400M into biotech licensing obesity drugs from China

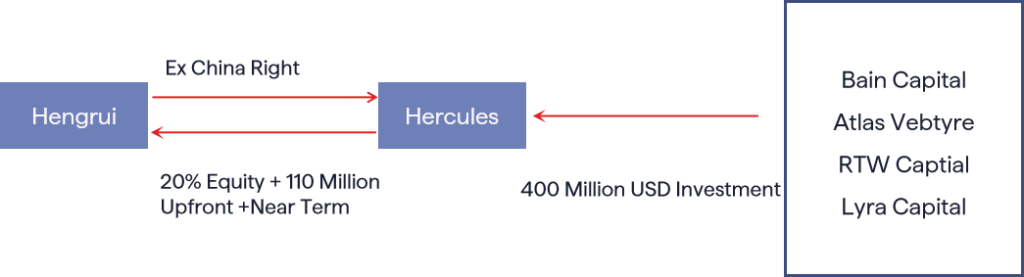

Hercules CM NewCo, Inc. is a biotech company based in Delaware. It was founded with $400 million in funding. This funding came from Bain Capital, Atlas Ventures, RTW Capital, and Lyra Capital.

As part of its expansion strategy, Hengrui Pharmaceuticals licensed the global (ex-China) rights for its GLP-1 portfolio to Hercules. In addition to standard licensing terms, Hengrui secured a 19.99% equity stake in the company.

Key Advantages of the NewCo Model

The NewCo model integrates global resources to accelerate drug development and commercialization. By spinning off non-core or early-stage assets, biotech firms can focus on priority pipelines. Drug development is costly, and most companies cannot advance all assets simultaneously. Divesting lower-priority projects secures external funding while preserving cash flow for key programs.

The NewCo model is gaining industry recognition as a flexible and forward-looking strategy. Whether through traditional licensing or innovative financial structures, it creates new opportunities for Chinese biopharma firms and global investors.

Challenges in Global Expansion

Despite progress in license-out and NewCo strategies, scaling independent commercialization remains a work in progress. Chinese biotech firms are advancing globalization efforts but still face four major challenges:

- Geopolitical and trade uncertainties

- High R&D costs and tighter funding conditions

- Regulatory hurdles and complex market access requirements

- Market expansion difficulties and limited brand recognition

As the global pharmaceutical market continues to evolve, the NewCo model is gaining increasing attention for its flexibility and forward-looking approach.

For Chinese biotech companies and external investors, this model creates new opportunities for global expansion. Whether following a steady, traditional path or embracing a more innovative approach, companies must carefully assess their strategies to maximize success.

The globalization of Chinese biotech firms typically unfolds in stages. It begins with API exports, followed by the development of innovative drugs for international markets. Companies then explore different commercialization models, progressing from license-out agreements to the NewCo model and, ultimately, to independent commercialization.

Choosing the right model is a critical part of any international strategy, requiring a balance between risk, control, and long-term growth potential. EC Innovations can help enterprises go global and accelerate their internationalization process.

Choosing the Right Partner

EC Innovations can help accelerate market entry and navigate regulatory landscapes worldwide. Our life science translation services help companies overcome language barriers in international business and comply with all regulation requirements. We offer support for 250+ language pairs and can address the full scale of your translation needs. Interested in learning more about Life Science Translation? Contact us, we will be happy to support you.